Health

AeroVironment offers comprehensive health plans, benefits coverage, and wellness options to promote and support your well-being.ERISA as well as various other state and federal laws require that employers provide disclosure and annual notices to their plan participants. Click on our Annual Notices packet link below for detailed information.

The following is a brief description of the annual notices:

- Medicare Part D Notice of Creditable Coverage: Plans are required to provide each covered participant and dependent a Certificate of Creditable Coverage to qualify for enrollment in Medicare Part D prescription drug coverage when qualified without a penalty. This notice also provides a written procedure for individuals to request and receive Certificates of Creditable Coverage.

- Women’s Health and Cancer Rights Act (WHCRA): The Women’s Health and Cancer Rights Act (WHCRA) of 1998, provides benefits for mastectomy-related services including all stages of reconstruction and surgery to achieve symmetry between the breasts, prostheses, and complications resulting from a mastectomy, including lymphedema. For more information, you can reach out to AVBenefits@avinc.com, or The U.S. Department of Labor Employee Benefits Security Administration at askebsa.dol.gov, or call toll free 1-866-444-3272.

- Newborns’ and Mothers’ Health Protection Act: The Newborns’ and Mothers’ Health Protection Act of 1996 (NMHPA) affects the amount of time a mother and her newborn child are covered for a hospital stay following childbirth.

- HIPAA Notice of Special Enrollment Rights: Plan participants are entitled to certain special enrollment rights outside of AeroVironment’s open enrollment period. This notice provides information on special enrollment periods for loss of prior coverage or the addition of a new dependent.

- Medicaid & Children’s Health Insurance Program: Some states offer premium assistance programs for those who are eligible for health coverage from their employers, but are unable to afford the premiums. This notice provides information on how to determine if your state offers a premium assistance program.

- HIPAA Notice of Privacy Practices: This notice is intended to inform you of the privacy practices followed by AeroVironment’s group health plan. It also explains the federal privacy rights afforded to you and the members of your family as plan participants covered under a group plan.

- Summary of Benefits and Coverage (SBC): Health insurance issuers and group health plans are required to provide you with an easy-to-understand summary about your health plan’s benefits and coverage. This regulation is designed to help you better understand and evaluate your health insurance choices. The SBC for AeroVironment’s plan can be found on AVConnect.

Documents

2024 Annual Health Notices 2023 SAR AEROVIRONMENT INC. EMPLOYEE BENEFIT PLANCOBRA continuation of coverage is the opportunity to continue your current employer based health care coverage when there’s a “qualifying event” that would result in a loss of coverage under the AV plan.

If you’re an employee, you’ll become a qualified beneficiary if you lose your coverage under the Plan because of the following qualifying events:

- Your hours of employment are reduced, or

- Your employment ends for any reason other than your gross misconduct.

For a full list of qualifying events you and/ or your covered dependent maybe eligible for, please review the attached General Notice.

COBRA continuation coverage is the same coverage that the Plan provides active employees and their covered dependents. Each “qualified beneficiary” (a qualified beneficiary is an individual covered by a group health plan on the day before a qualifying event occurred that caused him or her to lose coverage) who elects COBRA continuation coverage will also have the same rights under the Plan as other participants covered under the Plan.

AV has retained the services of CobraGuard, (a division of iTEDIUM) to administer all COBRA group health plans sponsored by AV. Correspondence on how to apply for COBRA coverage will be sent in the mail directly from Cobraguard.

Documents

General NoticeCigna | PPO Dental Plan With the Cigna Preferred Provider Organization (PPO) dental plan, you may visit a PPO dentist and benefit from the negotiated rate or visit a non-network dentist. When you utilize a PPO dentist, your out-of-pocket expenses will be less. You may also obtain services using a non-network dentist; however, you will be responsible for the difference between the covered amount and the actual charges and you may be responsible for filing claims. Note: We strongly recommend you ask your dentist for a predetermination if total charges are expected to exceed $300. Predetermination enables you and your dentist to know in advance what the payment will be for any service that may be in question. To find an in-network provider, please visit www.cignadentalsa.com.

Documents

Dental_Summary Plan Description Dental Claim Form Cigna - Find a DentistWho May Enroll

If you are a regular full-time employee working at least 30 hours per week, you and your eligible dependents may participate in AeroVironment’s benefits program. Your eligible dependents include:

- Legally married spouse

- Registered domestic partner (enrollment varies by plan). See plan documents for details

- Children under the age of 26, regardless of student or marital status

When You Can Enroll

As an eligible employee, you may enroll at the following times:

- As a new hire, you may participate in the company’s benefits program on your date of hire (Vision enrollment is the 1st of the month you are hired in or the following month depending on your first day of employment)

- Each year, during open enrollment

- Within 30 days of a qualifying event as defined by the IRS (see Changes To Enrollment below)

- You may enroll in Voluntary Life and AD&D insurance at any time, subject to proof of good health and carrier approval

Paying For Your Coverage

The Employee Assistance Program, Basic Life/AD&D and Long Term Disability benefits are provided at no cost to you and are paid entirely by AeroVironment. You and the company share in the cost of the Medical and Dental benefits you elect. Any Vision, Voluntary Life/AD&D, Short Term Disability, Long Term Care or Supplemental benefits you elect will be paid by you at discounted group rates. Your Medical, Dental, and Vision contributions are deducted before taxes are withheld which saves you tax dollars. Paying for benefits before-tax means that your share of the costs are deducted before taxes are determined, resulting in more take home pay for you. As a result, the IRS requires that your elections remain in effect for the entire year. You cannot drop or change coverage unless you experience a qualifying event.

Changes To Enrollment

Our benefit plans are effective January 1st through December 31st of each year. There is an annual open enrollment period each year, during which you can make new benefit elections for the following January 1st effective date. Once you make your benefit elections, you cannot change them during the year unless you experience a qualifying event as defined by the IRS. Examples include:

- Marriage, divorce, legal separation or annulment

- Birth or adoption of a child

- A qualified medical child support order

- Death of a spouse or child

- A change in your dependent’s eligibility status

- Loss of coverage from another health plan

- Change in your residence or workplace (if your benefit options change)

- Loss of coverage through Medicaid or Children’s Health Insurance Program (CHIP)

- Becoming eligible for a state’s premium assistance program under Medicaid or CHIP

Please note that coverage for a new dependent is not automatic. If you experience a qualifying event, you have 30 days to update your coverage. You will be provided instructions for enrollment. If you do not update your coverage within 30 days from the qualifying event, you must wait until the next annual open enrollment period to update your coverage.

<b><a href="" target="_blank">2023 Benefits Overview Booklet</a></b>

Documents

2023 Benefit Action Guide Benefit Enrollment Job Aid HSA_payroll deduction TrustMark Mobile App TrustMark Member Portal Registration HSA online account setup Provider Look UpYou can set aside money in Flexible Spending Accounts (FSAs) before taxes are deducted to pay for certain health and dependent care expenses, lowering your taxable income and increasing your take home pay. Only expenses for services incurred during the plan year are eligible for reimbursement from your accounts. You choose how you would like to pay for your eligible FSA expenses. You may use a debit card provided by WageWorks or pay in full and file a claim for reimbursement. Please remember that if you are using your debit card, you must save your receipts, just in case WageWorks needs a copy for verification. Also, all receipts should be itemized to reflect what product or service was purchased. Credit card receipts are not sufficient per IRS guidelines.

Health Equity | Health Care Spending Account (HCSA)

This plan is used to pay for expenses not covered under your Medical, Dental, and Vision plans, such as deductibles, coinsurance, copays and expenses that exceed plan limits. You may defer up to $3,300 pre-tax per year. The FSA Store provides a list of what is reimbursable under this plan.

FSA Eligible Expenses & FSA Eligible Items | WageWorks

Health Equity | Dependent Care Assistance Plan (DCAP)

This plan is used to pay for eligible expenses you incur for childcare, or for the care of a disabled dependent, while you work. You may defer up to $5,000 pre-tax per year (or $2,500 if you are married but file taxes separately).

FSAs offer sizable tax advantages. The trade-off is that these accounts are subject to strict IRS regulations, including the use-it-or- lose-it rule. According to this rule, you must forfeit any money left in your account(s) after your expenses for the year have been reimbursed. The IRS does not allow the return of unused account balances at the end of the plan year, and remaining balances cannot be carried forward to a future plan year. We encourage you to plan ahead to make the most of your FSA dollars. If you are unable to estimate your health care and dependent care expenses accurately, it is better to be conservative and underestimate rather than overestimate your expenses.

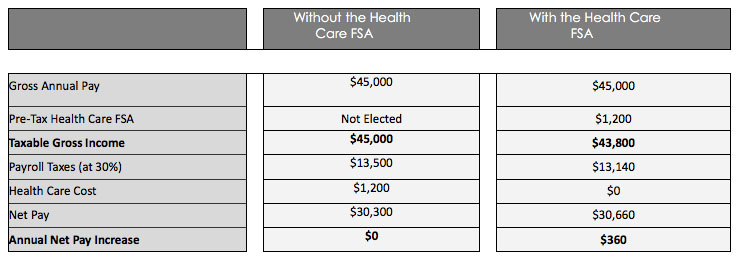

Example

Dan estimates that he will have approximately $1,200 in out-of-pocket health care expenses next year and is looking to increase his take-home pay.

Important Note About the FSA It is important to note that your FSA elections will expire each year on January 31st. If you plan to participate in the FSA for the upcoming plan year, you are required to re-enroll.

For more information, please visit: http://www.healthequity.com/wageworks

Documents

Quickstart Guide DCFSA FSA Summary Plan Description (SPD)An HSA is a tax-advantaged savings account that belongs to you. You must be enrolled in AV's High Deductible Health Plan (HDHP) to enroll in this benefit. The HSA can be used, tax-free, to cover:

- Your insurance deductible

- Qualified healthcare expenses that insurance plans might exclude

- Co-payments and Coinsurance

- Qualified medical, vision, or dental expenses

AV will make a bi-weekly contribution towards your annual maximum regardless if you make a contribution. Current company contributions are up to $500.00 / year for employee only coverage or up to $1000.00 per year for employee + dependent(s) coverage.

Documents

HSA Investments HSA and Medicare HSA Transfer FormHealthJoy is a mobile app that provides healthcare guidance, mental health care, and support. You may call or chat with employee benefits experts whenever you have a question. The HealthJoy benefits wallet makes it easy to access your employee benefit cards in one location. Your dependent(s), ages 18 or older, may also request to set up their own account with HealthJoy. All benefit eligible employees may access the HealthJoy app. Employees enrolled in AV medical plans may access additional concierge services.

Documents

What is HealthJoy Tip Sheet How to Download and Activate HealthJoy Teladoc Mental Health CareAV provides Hearing Aid discount programs through Mutual of Omaha (Amplifon). These programs provide members up to 60% off retail on brand name hearing aids from major manufactures. Program patient care advocates will help you find a hearing care provider in your area, assist in making a hearing appointment, and will explain plan options and costs. For additional information, please select one of the plan documents below.

Documents

Mutual of Omaha Hearing Discount ProgramAV is offering a Hospital Indemnity Plan designed to provide financial protection for covered individuals by paying a lump sum benefit if you are admitted to the hospital. This plans also includes a daily benefit for days spent confined in the hospital. Additionally, included in this plan is an annual payment to covered individuals for “Be Well Screening Tests.”

Documents

Be Well flyer Claim Filing Plan Summary and Cost Certificate BookletAV is in partnership with International SOS (ISOS) to provide an important international travel resource to all employees. ISOS offers our travelers unique medical, safety and security expertise to employees when traveling or living abroad. As an ISOS member, you receive extended security assistance 24/7, no matter where you live or travel internationally on AV’s behalf.

Contact ISOS anytime and anywhere when you venture out of the country. No issue is too small. Get support with:

- Advice before a trip

- A referral for a local doctor, dentist or other care

- Routine or urgent medical care, including evacuation

- Safety or security advise from a trained professional.

Documents

Membership Letter Benefits overview and access instructions Membership IDUsing LiveHealth Online, you can have a private and secure video visit with a board-certifed doctor 24/7 on your smartphone, tablet, or computer. It’s a quick and easy way to get the care you need with no appointments or long wait times. When your doctor isn’t available, use LiveHealth Online. A doctor can assess your condition, provide a treatment plan, and even send a prescription to your pharmacy, if it’s needed.

With LiveHealth Online, you get:

- Immediate doctor visits through live video.

- Your choice of U.S. board-certified doctors.

- Help at a cost of your regular copay (per visit).

- If you are not on AV’s health plan, you can still access this benefit (go to www.livehealthonline.com for more information).

- Private, secure and convenient online visits.

- Your copayment will apply at the time of your online visit.

- Please have a credit card handy for payment purposes.

- See the flyer below for more information on this service!

My Nurse will give you access to medical guidance 24/7/365 at NO COST to you. MyNurse 24/7 is your first resource for immediate clinical guidance on everyday health issues. Support is available in English, Spanish, or 240 other languages. MyNurse 24/7 helps you avoid unnecessary and expensive trips to the doctor or ER. Plus, our nurses may be able to help identify an emerging condition before it becomes more severe.

Documents

LiveHealth Online Information My Nurse 24/7 SupportAnthem Blue Cross | PPO & HDHP Medical Plans

The Preferred Provider Organization PPO - High and PPO - Low plans allow you to direct your own care. You are not limited to the physicians within the network and you may self-refer to specialists. If you receive care from a physician who is a member of the network, a greater percentage of the cost will be paid by the insurance plan. You may also obtain services using a non-network provider; however, you will be responsible for the difference between the covered amount and the actual charges. You may also be responsible for filing claims.

The High Deductible Health Plan (HDHP) allows you the freedom to choose your doctor with the requirement of selecting a PCP. You may also self-refer to specialists. In-network providers will have negotiated rates and provide a richer level of benefit. The HDHP combines a health plan with a special, tax-qualified savings account (HSA). AeroVironment will make a bi-weekly HSA contribution into your account based on your coverage type as well as allow you to make contributions to your account up to the current IRS maximums.

Prescription Drug Coverage

Anthem Blue Cross partners with CVS Caremark to provide your prescription drug coverage, which you automatically receive when you enroll in an AV medical plan.

With the CVS Caremark plan, you can either purchase your prescriptions at a participating retail pharmacy or use CVS Caremark’s mail-order service.

To access your pharmacy benefits, shop for the lowest cost and best pharmacy for your individual Rx, please visit https://www.caremark.com/wps/portal.

Documents

SPD - Summary Plan Description PPO Low_ Summary PPO High_Summary HDHP_Summary HSA_Life Events Medical Claim Form Medical Insurance Tips Luminare Health Portal Registration Coordination of Benefits (Secondary Medical Coverage) CVS Caremark Getting Started Guide CVS Caremark Readyfill Brochure CVS Caremark Rx Delivery by Mail Prescription Reimbursement Claim Form CVS/Caremark Maintenance Choice Program CVS/Caremark Generic Medication Info My Nurse Autism Spectrum Disorder How To Look Up a Provider SingleCare - RX Shopping tool CVS Mobile Specialty Preferred Drug ListEyeMed Vision | PPO Vision Plan

The EyeMed Vision plan provides professional vision care and high quality lenses and frames through a broad network of optical specialists. You will receive richer benefits if you utilize a network provider. If you utilize a non-network provider, you will be responsible to pay all charges at the time of your appointment and will be required to file an itemized claim with EyeMed Vision.

Note: The EyeMed Vision network includes access to independent ophthalmologists and optometrists, as well as LensCrafters, Pearle Vision, Sears Optical, Target Optical and JCPenney.

To find an in-network provider, please visit http://EyeMed.com.

Documents

EyeMed Summary of Benefits EyeMed Mobile App Special Offers Claim Form Cost Estimator Know before you go Cost Estimator toolWellhub allows you to have flexible access to thousands of activities with one membership. Along with their gym network of more than 10,000 gyms and studios around the country, Wellhub offers several at-home fitness and wellness options for you to stay active in the comfort of your own home. This includes Wellhub Wellness, a digital wellness platform that gives you access to on-demand apps featuring virtual workouts, kids-only content, nutrition planning resources, meditation and more.

To check it out, download the Wellhub app on Google Play or App Store, then Sign Up. Enter your Employee ID and create a password to start your Wellhub experience. You may also sign up by going to Wellhub.

Documents

Wellhub PricingAV offers a series of benefits and activities that promote health and wellbeing in the workplace.

Flu Shots

For employees who are actively enrolled in the AV health insurance plan, may have the option to receive a flu shot at no cost when given by an in-network medical provider or at a in-network pharmacy.

Health Wellbeing

Apps that supporting meditation, mental wellbeing, nutrition, physical wellbeing, and more with Wellhub.

Mindstream is a fitness studio for your mind at SupportLinc. Click here to get started. Unleash your potential with expert wellness and mental health content on a secure, easy-to-use platform. Dive into engaging sessions and streams to supercharge your emotional health, enhance your life skills, and so much more!

Mental Health Resources

From Anthem and LiveHealth to our EAP, AV has resources to support your emotional wellbeing and work/life balance.

What is SupportLinc EAP? Click here to learn more.